Brand Promise: To help cardmembers achieve a brighter financial future.

Problem: Many credit card brands offer the same mix of products, but do little to ease people's money anxieties.

Insight: By designing tools around real behaviors, you can transform a brand into a trusted partner.

Solution: We reimagined and innovated the finance experience. Privacy Tracker lets you remove personal data from sites that took it without permission. Fit Fund connects everyday health tracking with automated savings. Freeze It, now an industry standard, turns card security into a simple on/off switch. These concepts all help Discover step out of the financial sector’s sea of sameness using human-centered innovation to protect customer privacy, encourage better habits, and offer more control over their financial lives.

Role: Concept & CREATIVE Direction | YEAR: 2023, 2016

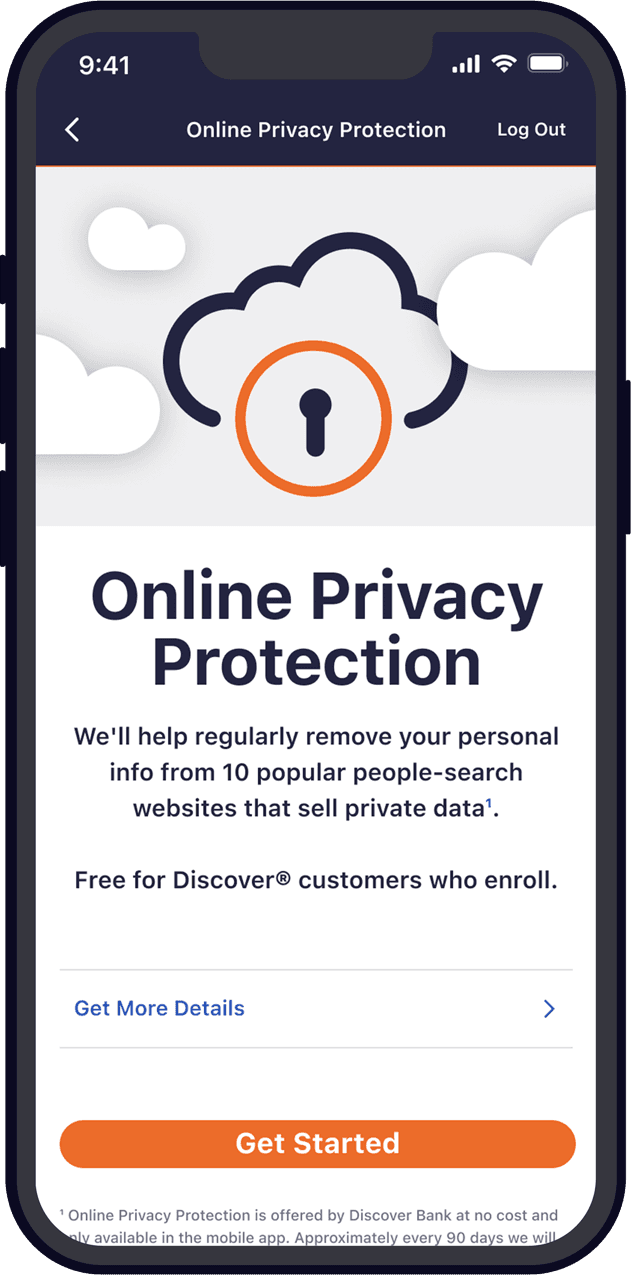

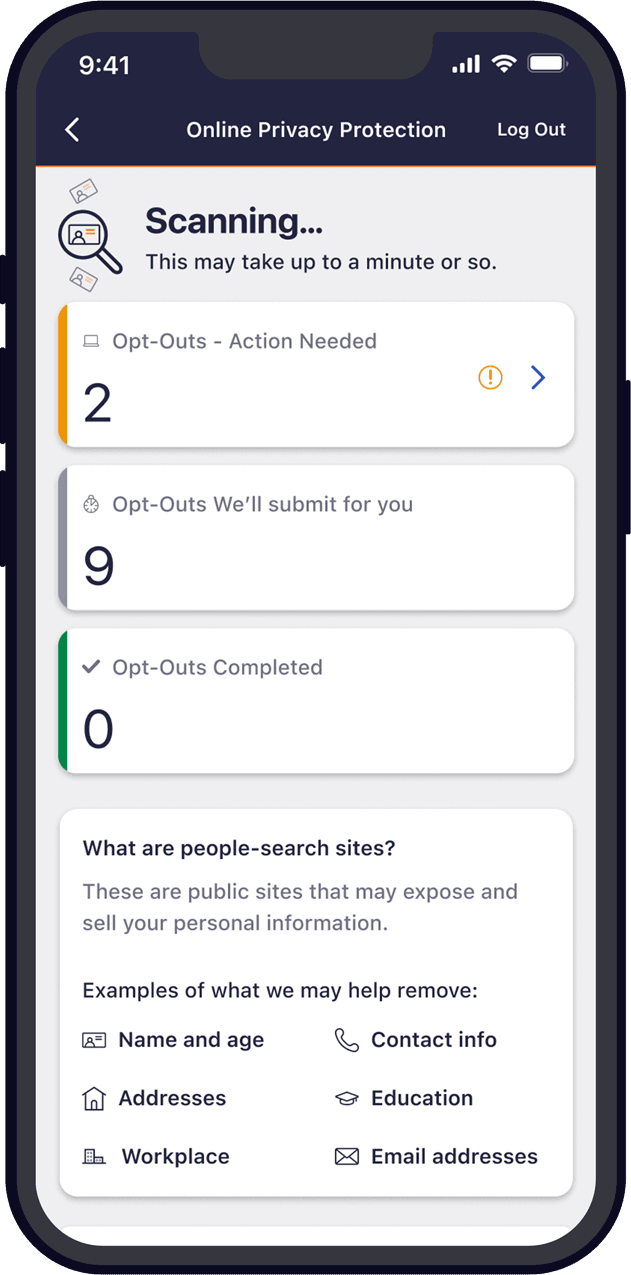

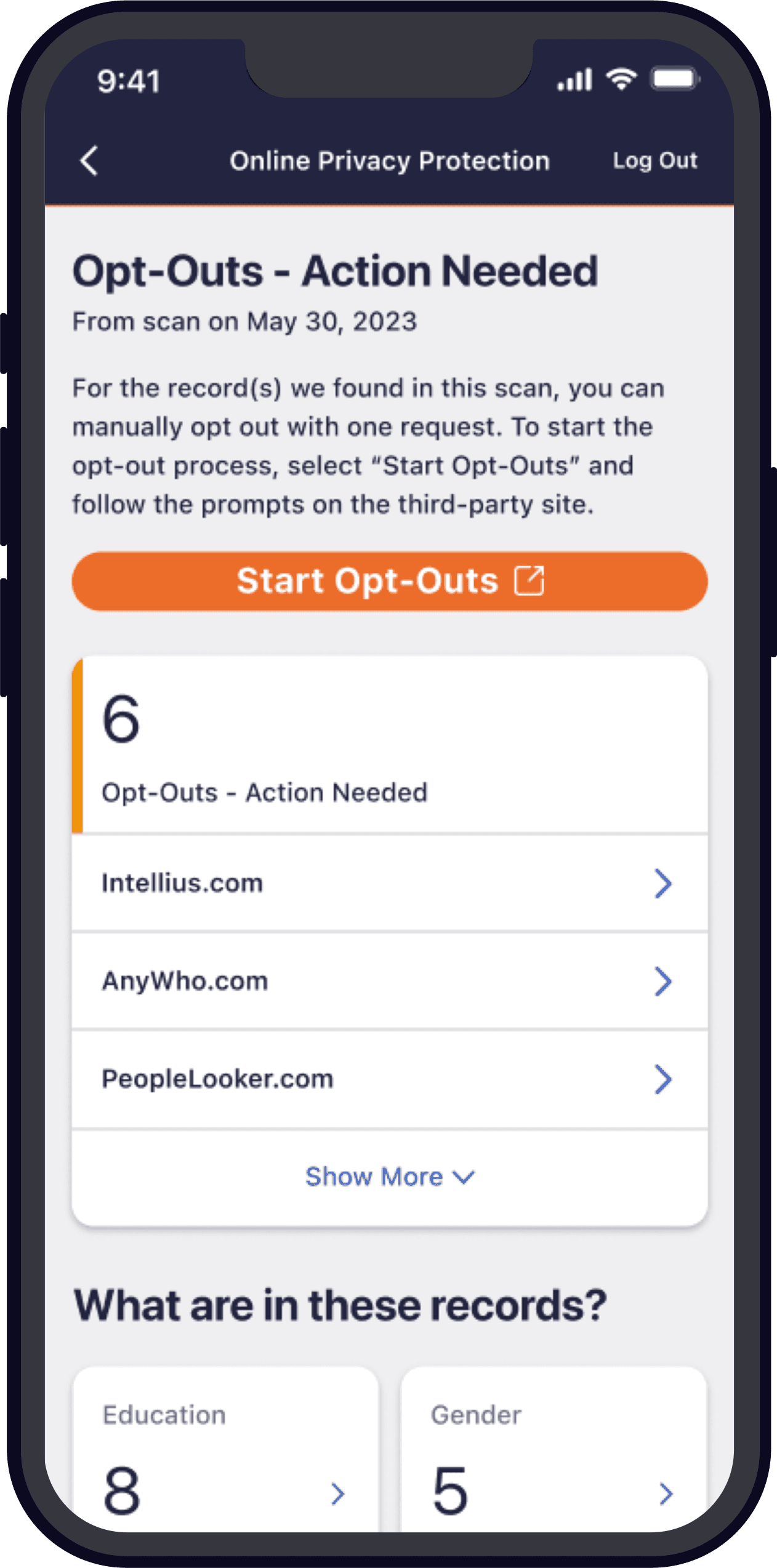

PRIVACY TRACKER

A first-in-kind digital tool that allows customers to take back control of their online privacy.

With a single tap, your private information is removed from websites that took it without your permission, giving you peace of mind.

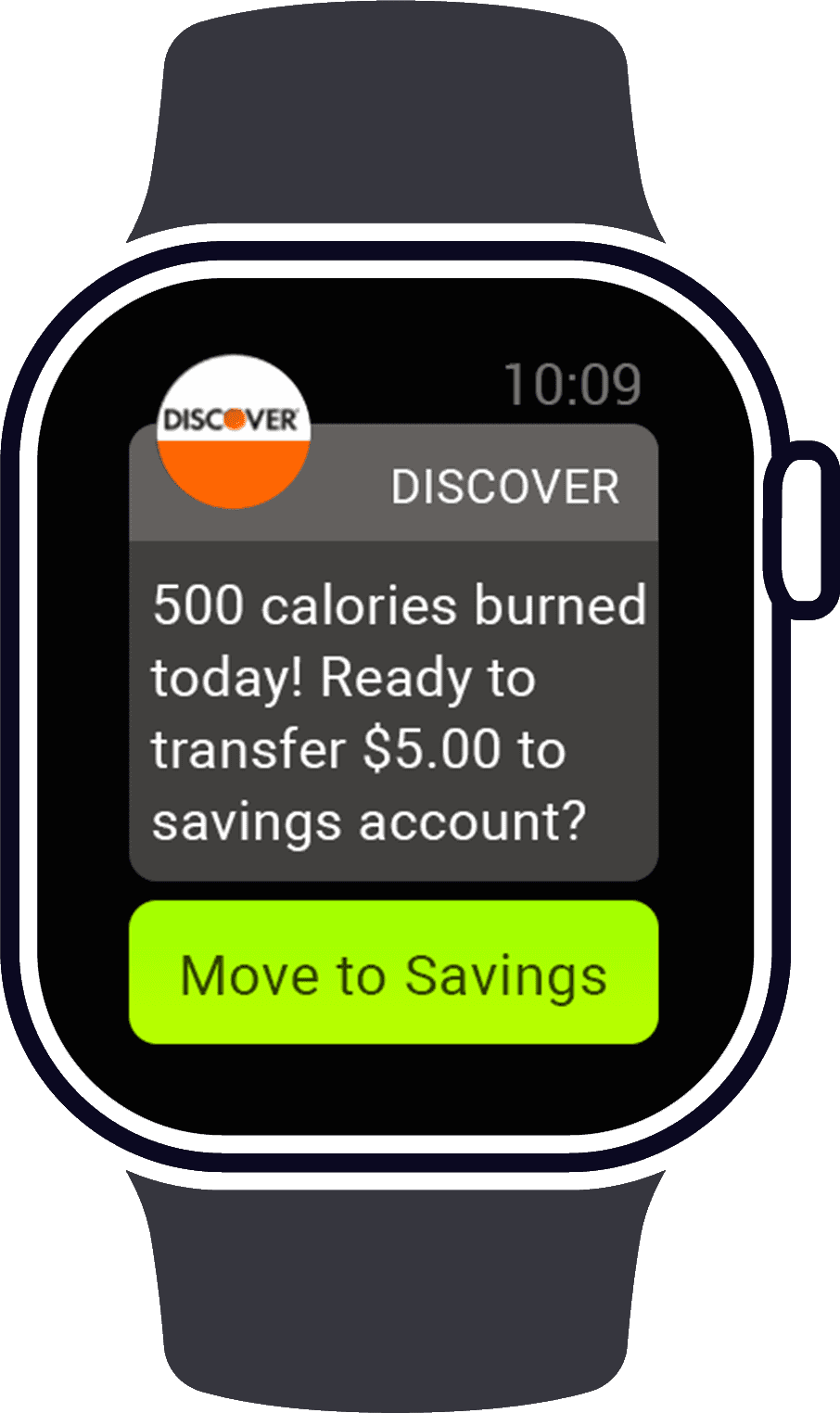

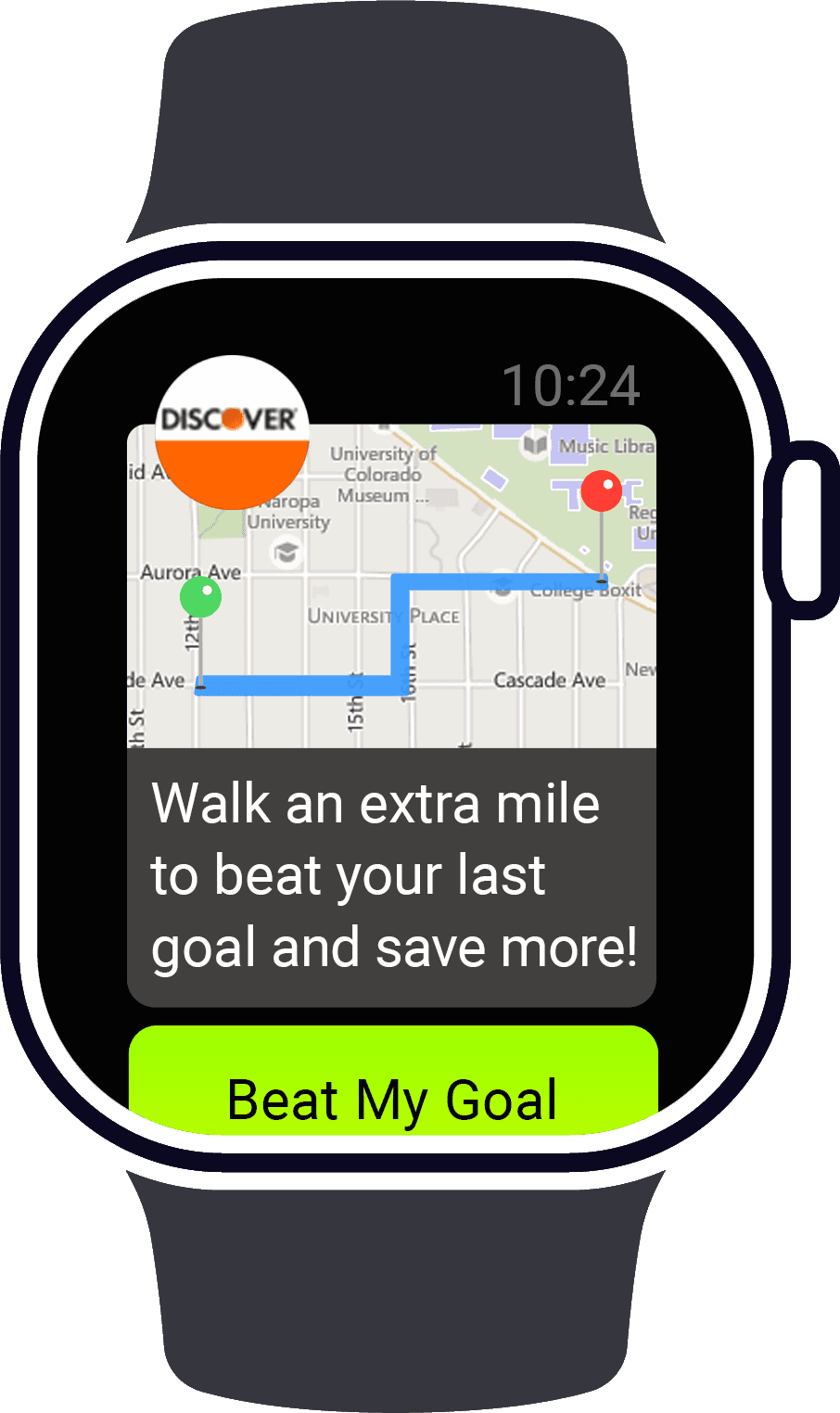

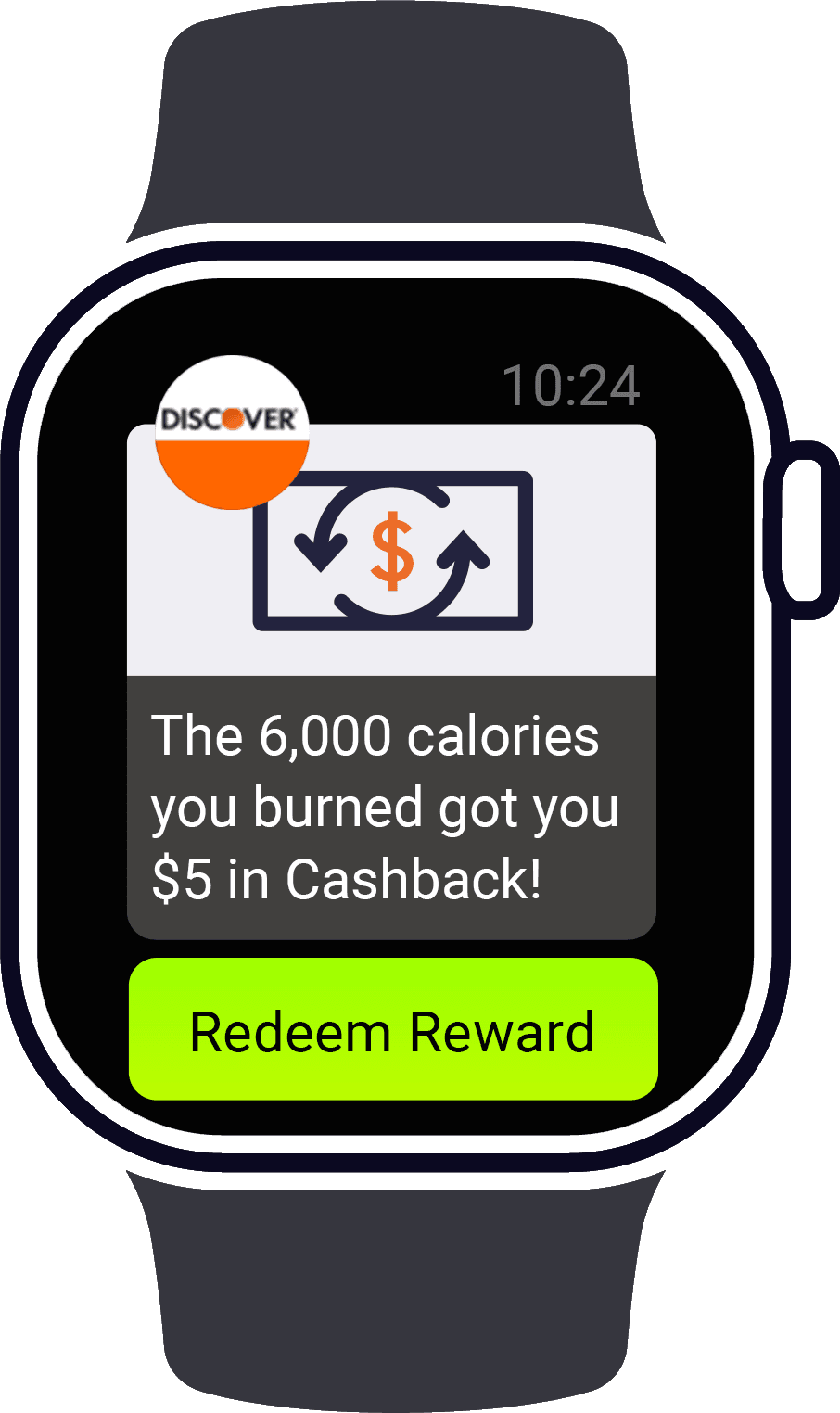

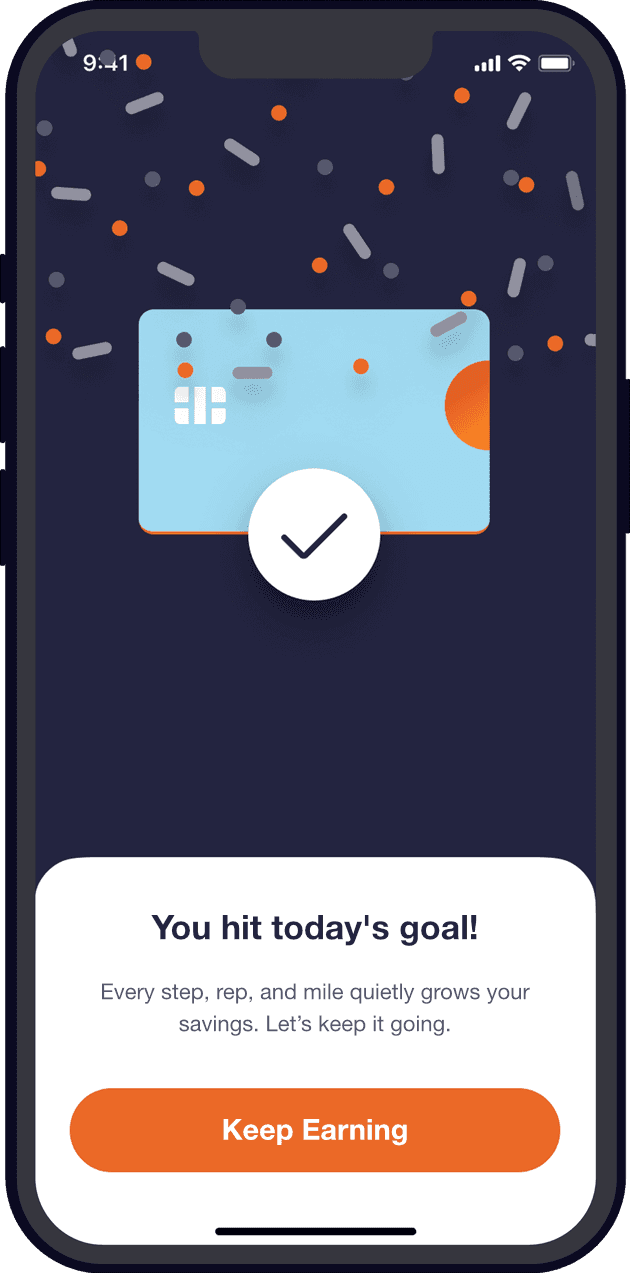

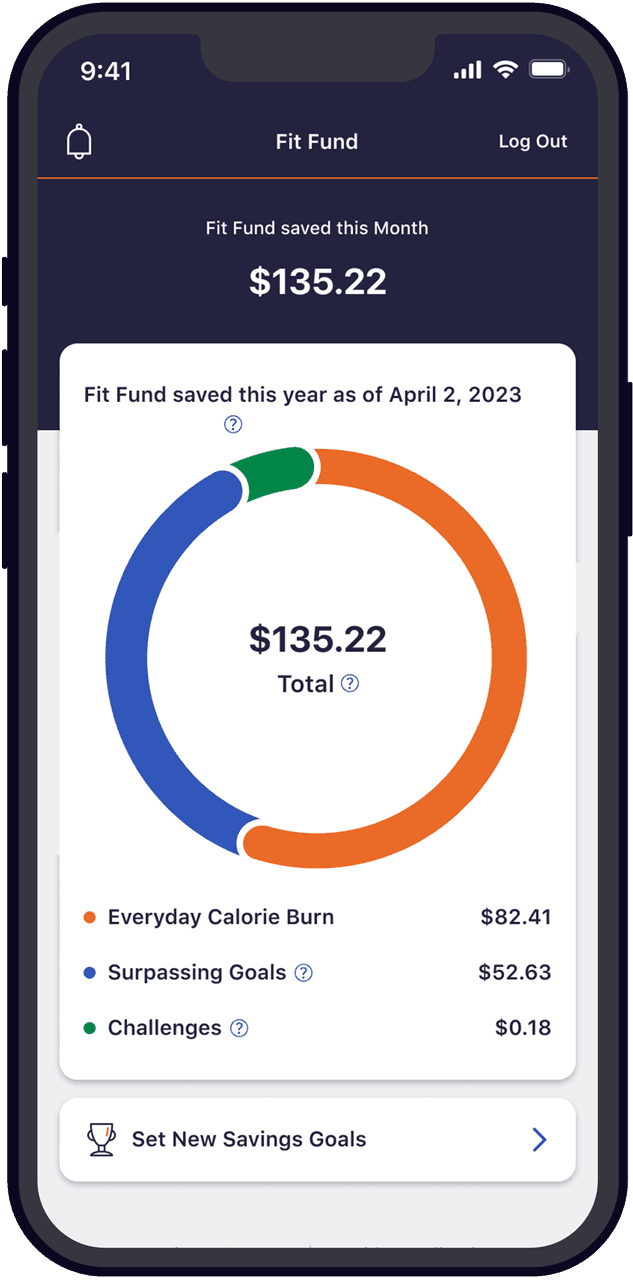

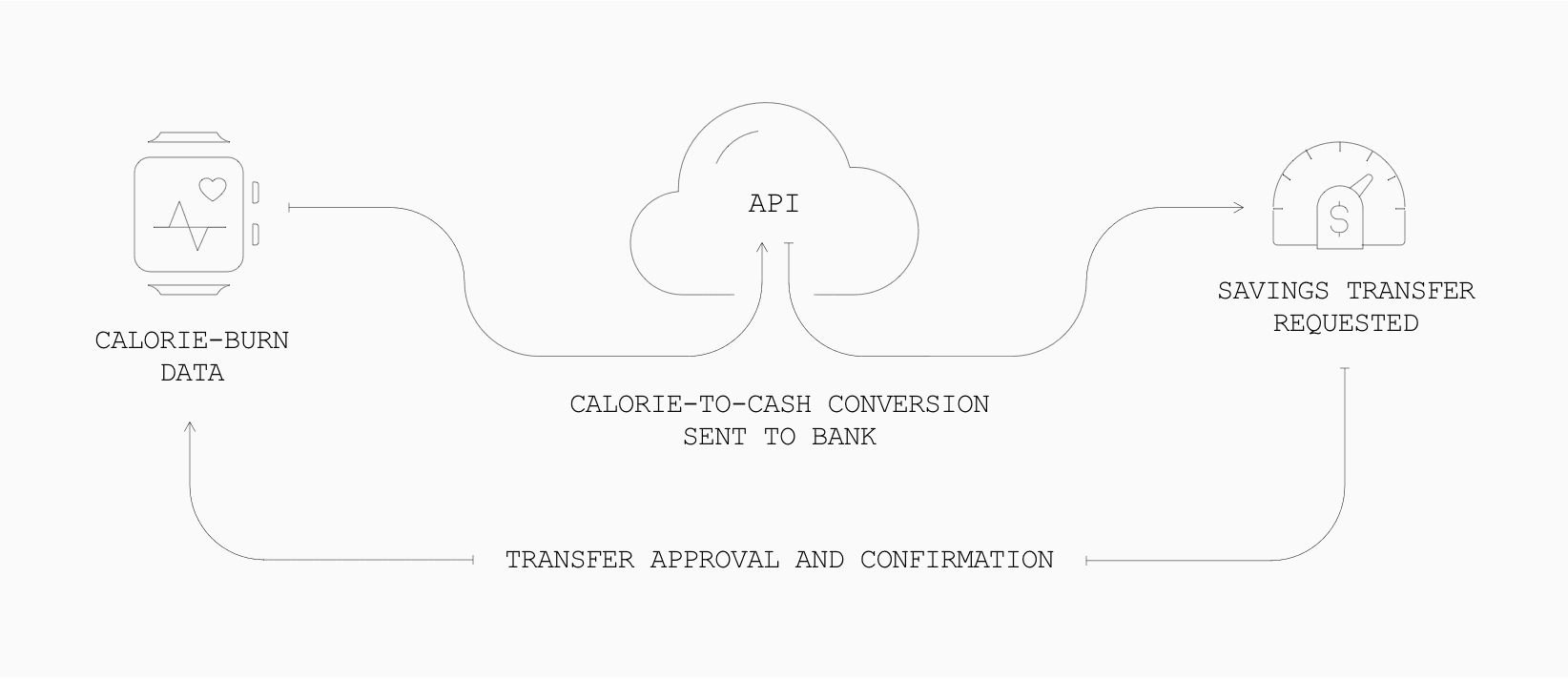

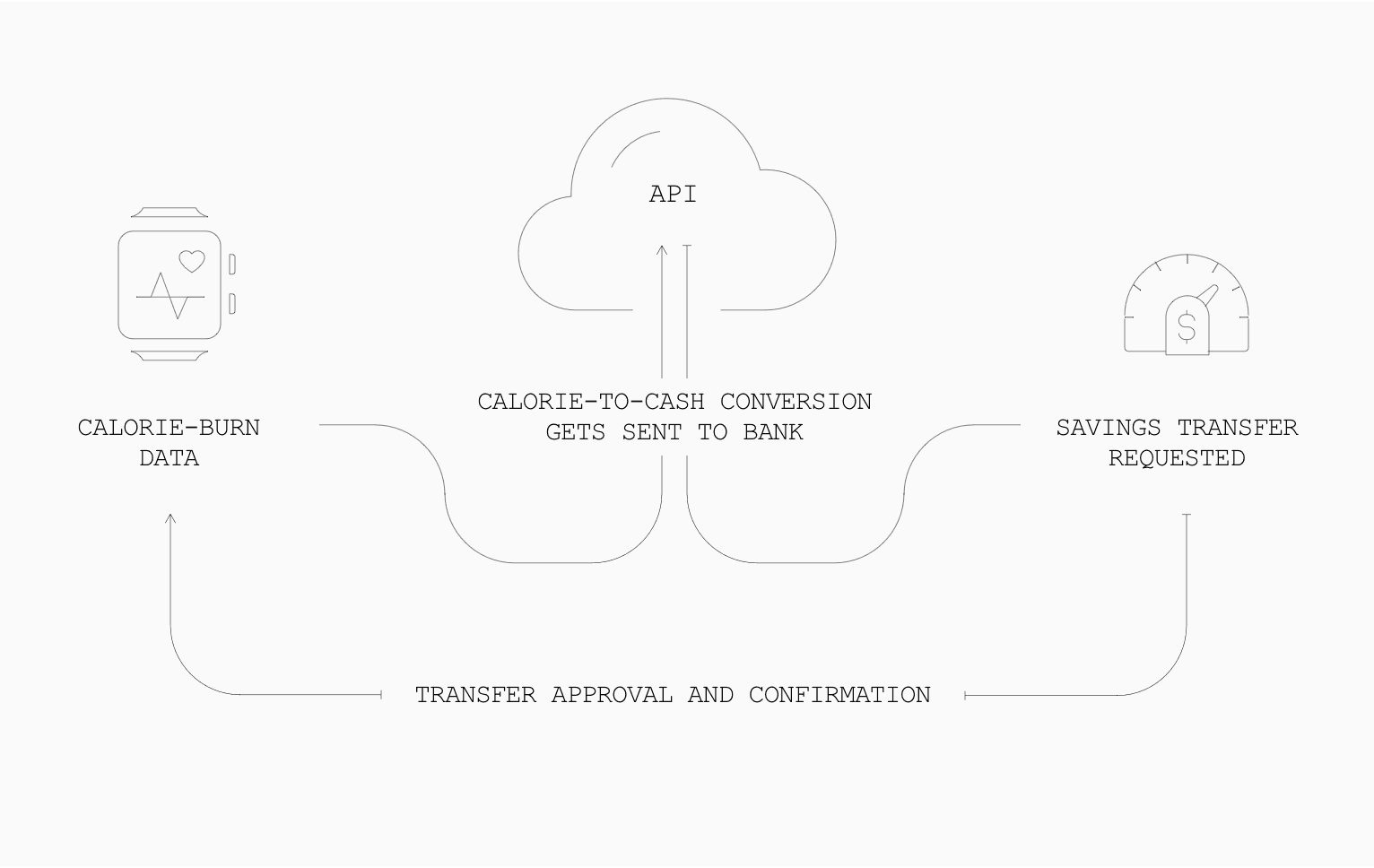

FIT FUND

For every calorie burned, money is automatically transferred into your savings account

A simple experience to help you save

FREEZE IT

The first-ever on/off switch for your credit card